MEET THE FOUNDERS

KENNY & ROCHELLE GODFREY

A husband and wife team who believe life insurance should be clear, honest, and centered around people, not policies. Secure With Godfrey was built from personal experience, not just professional training.

Early in life, Kenny lost his father without proper life insurance in place. What followed was confusion, financial strain, and unanswered questions during an already painful time. That experience reshaped how we view protection and responsibility and showed us how many families are left vulnerable simply because no one took the time to explain their options.

We Are Independent Brokers, Not Agents

We work for you, not insurance carriers

As independent brokers, we are able to compare policies from multiple top-rated carriers, tailor coverage to your unique needs, and advocate for you throughout the entire process. Our role is to educate and guide you so you can make informed decisions with confidence.

Services We Offer

Term Life Insurance

Permanent & Whole Life Insurance

Final Expense Coverage

Family & Legacy Planning

Mortgage Protection

Ready for a free educational session?

Jasmine R.

Swift setup for Home and Life Insurance. Secure With Godfrey made it all so easy and stress-free! Definitely recommended.

Monica C.

Tried a few brokers before; Secure With Godfrey really nailed it with their life and auto insurance offerings. Straightforward, no hassle, exactly what I needed.

Thomas K.

Secure With Godfrey streamlined our business insurance effortlessly. No fuss, just solid advice and excellent options tailored right for my company’s needs. Very satisfied.

Explore Our Customized Insurance Solutions for You

Discover tailored insurance solutions designed to secure your peace of mind.

Comprehensive Home Insurance Coverage

Home Insurance Solutions - Tailored coverage for homeowners, renters, and landlords against disasters, theft, and accidental damage.

Comprehensive Life Insurance Plans

Tailored life insurance solutions, including term, whole, and universal life policies, ensuring financial security and peace of mind for dependents.

Business Risk Coverage Consulting

Specialized business insurance consulting to safeguard enterprises with liability, property, employee, and interruption coverage tailored to unique business needs and risks.

Common Life Insurance Questions

What happens if I miss a payment?

Most policies include a grace period. Missing payments long-term can cause coverage to lapse, but options may exist depending on the policy type. Communication with your broker is important if circumstances change.

What is the biggest life insurance myth?

That it is too expensive or unnecessary. Most people are surprised by how affordable and flexible modern life insurance actually is.

How often should I review my life insurance policy?

Policies should be reviewed when major life events occur, such as marriage, children, buying a home, or career changes. Even without major changes, a periodic review is helpful.

Does life insurance cover all causes of death?

Most life insurance policies cover death from natural causes and accidents. Some policies may also include additional accidental death benefits, depending on the coverage selected.

Regarding suicide, most life insurance policies include a suicide clause, which means that if death occurs by suicide within a specified period after the policy is issued, typically the first two years, the death benefit may not be paid. After this period, suicide is generally covered under the policy.

Specific terms vary by carrier and policy, which is why reviewing the details of your coverage is important.

What is the contestability period?

The contestability period is the initial timeframe after a policy is issued, usually two years, during which the insurer can review and verify application details. After this period, the policy is generally secure.

Can life insurance be denied later?

Policies can be contested within a limited time if material information was misrepresented. This is why honesty and transparency during the application process are essential.

Can I get life insurance if I have pre-existing conditions?

Often, yes. Many carriers specialize in different health profiles. Conditions like high blood pressure, diabetes, or asthma do not automatically disqualify you. The key is placing your application with the right carrier, and that is one of the many benefits you get when working with an independent broker.

Does everyone qualify for life insurance?

Not everyone qualifies for every type of life insurance, but most people can qualify for some form of coverage.

Eligibility depends on factors such as age, health, lifestyle, occupation, and coverage amount. Some policies have stricter requirements, while others are designed to be more flexible.

For individuals with health concerns or past issues, there are often options available, including policies with simplified underwriting or modified benefits.

The key is working with a broker who understands how different carriers evaluate risk. As independent brokers, we can help identify the options that best fit your situation rather than applying blindly and risking unnecessary declines.

Even if traditional policies are not an option, there are often alternatives worth exploring.

How young do you have to be to get life insurance?

Life insurance can be purchased at almost any age, including for children. Some policies are available as early as 14 days old, while others are designed for adults starting in their late teens.

For adults, many people qualify for life insurance starting around 18 years old, depending on the carrier and type of policy.

Getting coverage early often means:

• Lower premiums

• Better health ratings

• More options

• Long-term cost savings

Many families also choose policies for children to lock in insurability and provide long-term protection.

Life insurance is not about age alone. It is about protecting future insurability and planning ahead.

What about life insurance through my job?

Employer provided life insurance is helpful but often limited.

Common issues include:

• Coverage amounts are usually low

• It may not follow you if you leave your job

• You typically cannot customize it

• It may not be enough to fully protect your family

Workplace coverage is best viewed as a supplement, not a complete solution.

Can I have both workplace and personal life insurance?

Yes, and many people do. Personal life insurance ensures you stay protected regardless of job changes and allows you to choose coverage that fits your actual needs.

Who receives the life insurance payout?

You choose your beneficiaries. This can include:

• A spouse

• Children

• Family members

• A trust

Payouts are typically tax free and paid directly to beneficiaries.

How long does the approval process take?

In many cases, approval can happen quickly, sometimes within hours or days. Some policies may require additional steps depending on coverage amount and health history, but we guide you through every step.

What happens if my life changes after I get coverage?

Life insurance should adapt as your life changes. Marriage, children, home purchases, and career changes are all reasons to review coverage. As brokers, we can help reassess and adjust when needed.

Why does my broker need full transparency about my health and lifestyle?

Full transparency allows your broker to place your application with the right insurance carrier from the start. Every insurer evaluates risk differently, so details about your health, lifestyle, occupation, and habits help us identify which companies are most likely to offer you the best terms.

Being honest does not automatically disqualify you. In many cases, it actually improves your outcome by avoiding delays, unnecessary declines, or policy changes later. Incomplete or inaccurate information can lead to higher premiums, denied claims, or even policy cancellation if discrepancies are discovered.

Transparency allows your broker to advocate for you, set realistic expectations, and ensure the coverage you choose performs exactly as intended when it matters most.

Why do you offer a free educational session?

Because most people are not avoiding life insurance. They simply do not understand how life insurance works.

Our free educational session is designed to:

• Explain what life insurance is

• Review your options

• Answer any questions you may have

• Shop around for best rates that fit your budget

There is no pressure and no obligation. Education comes first.

What makes working with a broker different?

As independent brokers, we work for you, not insurance carriers. This allows us to compare multiple top rated carriers, tailor coverage to your needs, and focus on guidance.

“I’m paying all this money and don’t see any benefit while I’m alive.”

This is one of the most common concerns, and it comes from how life insurance is often explained.

Many modern life insurance policies include living benefits, meaning you can access a portion of your policy while you are still alive if you experience a qualifying illness or event.

Living benefits may allow access to funds in cases such as:

• Critical illness

• Chronic illness

• Terminal illness

These benefits can help cover medical costs, replace income, or reduce financial stress during difficult times. Not all policies include living benefits, which is why understanding your options matters.

Life insurance is not just about death. It is about protection during life as well.

“What if I never use my policy?”

If you never need to use your policy, that means it did its job quietly in the background. Much like car or home insurance, the value is in protection and peace of mind.

That said, some policies also offer features like cash value or living benefits, which can provide value beyond the death benefit.

What Is Cash Value?

Cash value is a savings component built into certain types of permanent life insurance policies, such as whole life and indexed universal life (IUL).

When you pay your premium, a portion goes toward:

• The cost of insurance coverage

• A cash value account that grows over time

This cash value grows inside the policy and is separate from the death benefit, though the two are connected.

This cash value can often be:

• Borrowed against

• Used for emergencies

• Used to supplement retirement income

• Used to help pay future premiums

Cash value grows tax deferred, meaning you do not pay taxes on the growth as long as it remains inside the policy. Depending on the type of policy, growth may be guaranteed at a fixed rate or linked to a market index (such as in an IUL) and is not the same as a traditional savings account. It is designed for long term planning, not short term spending.

When Can You Access Cash Value?

In most policies, cash value becomes accessible after the policy has had time to build. This typically takes a few years, depending on how the policy is structured and funded.

Access is not immediate, and cash value is not intended for short-term use.

How Can You Access the Cash Value?

There are two main ways to access cash value:

1. Policy Loans

A policy loan allows you to borrow against your own policy. The insurance company lends you the money, using your cash value as collateral.

Key things to know:

• You are not required to repay the loan on a set schedule

• Interest accrues on the loan balance

• Any unpaid loan reduces the death benefit

• If managed properly, loans can be tax advantaged

You are borrowing from the insurance company, not directly removing your cash value.

2. Withdrawals

Withdrawals permanently remove money from the policy.

Important considerations:

• Withdrawals may reduce the death benefit

• Excessive withdrawals can impact policy performance

• Some withdrawals may trigger taxes depending on the policy

Withdrawals are typically used more cautiously than loans.

Who Pays the Loan Back?

You do, but repayment is flexible. You can repay the loan over time, choose not to repay it, or allow the balance to be deducted from the death benefit. Many people use policy loans without repayment, understanding the impact on their beneficiaries.

What If a Loan Is Not Repaid?

Unpaid loans reduce the death benefit and continue to accrue interest. If the balance grows too large, the policy could lapse, which is why proper guidance and ongoing monitoring are important.

Common Uses for Cash Value

Cash value may be used for emergencies, supplemental retirement income, major life expenses, or to help cover premiums later in life. Each use should be carefully planned to protect the policy.

Is Cash Value the Same as a Savings Account?

No. Cash value is not meant for frequent withdrawals or short-term use. It grows over time and is tied to the structure of the insurance policy, making it a long-term planning tool rather than a traditional savings account.

What Is Mortgage Protection?

Mortgage protection is specific type of term life insurance designed to help cover your mortgage if you pass away.

The goal is to:

• Prevent your family from losing the home

• Reduce financial stress during an already difficult time

• Provide funds to pay off or help pay the mortgage

Coverage can be customized based on:

• Mortgage balance

• Term length

• Budget

Mortgage protection is not required, but many homeowners choose it for peace of mind.

What Makes an IUL Different From Other Life Insurance?

Compared to Term Life Insurance

Term life provides protection for a specific period but does not build cash value. An IUL provides lifetime coverage and the potential to build long term cash value.

Compared to Whole Life Insurance

Whole life typically offers guaranteed growth at a fixed rate. IULs offer growth potential tied to market performance, which can be higher over time, though not guaranteed.

Compared to Traditional Investing

IULs are not investments. They are insurance products with built-in protection. Unlike investments, IULs:

• Do not lose value due to market downturns

• Offer tax advantaged growth

• Provide a death benefit

“Is it better to wait until I’m older, to get life insurance?”

Waiting typically increases cost and limits options. Locking in coverage earlier often means better pricing and more flexibility later.

Tomorrow is never promised, that is why the best time is now.

Does life insurance cover death overseas?

In most cases, yes. Many policies cover death worldwide. Certain exclusions may apply depending on the policy and circumstances, which is why reviewing details matters.

Can I convert my term policy to permanent coverage?

Many term policies include a conversion option that allows you to convert to permanent insurance without new medical underwriting. Conversion options vary by policy and carrier.

What is life insurance and how does it work?

Life insurance is a contract that provides a tax free payout to your chosen beneficiaries if you pass away. Its purpose is to replace income, cover final expenses, pay off debts, and protect your loved ones financially.

Who needs life insurance?

Most people do, especially if anyone depends on your income or would be financially impacted by your passing. This includes:

• Married couples

• Parents

• Homeowners

• Business owners

• Anyone with debt or financial responsibilities

Life insurance is not just for parents or older adults.

“Is life insurance a scam?”

Life insurance is a regulated financial product that has protected families for generations. Confusion often comes from poor explanations or being sold a product that did not fit.

Education and proper guidance are what make the difference.

"How do I know if I qualify?"

Life insurance qualification depends heavily on your risk profile, assessed through age, health (medical history, current conditions, height/weight), lifestyle (smoking, alcohol, dangerous hobbies/job), and sometimes financial stability (income/assets) and driving record, all to estimate your life expectancy. Insurers use these factors to determine if you're eligible for coverage and what premium you'll pay, with lower risks generally leading to better rates.

Key Factors Influencing Qualification

Age & Gender: Younger applicants generally qualify for better rates due to longer life expectancy.

Health & Medical History: Your personal health (high blood pressure, diabetes, obesity) and family history are crucial. Insurers may require medical exams or statements.

Lifestyle: Smoking, heavy alcohol/drug use, and involvement in hazardous activities (e.g., skydiving, aviation) increase risk and premiums.

Occupation: High-risk jobs (e.g., construction, commercial fishing, law enforcement) can make qualification difficult or expensive.

Financial Stability: For large policies, income, net worth, and employment might be reviewed to ensure you can afford premiums and have a genuine need for insurance (insurable interest).

Driving Record: A history of speeding tickets or DUIs can raise concerns and affect approval or pricing.

This is why it is important to be honest and transparent with your broker. Inaccurate or incomplete information can delay approval, result in higher costs later, or even cause a policy to be declined or canceled. Transparency allows your broker to place your application with the right carrier from the start and advocate for you effectively.

“Why do different people pay different amounts for the same coverage?”

Pricing is based on several risk factors such as:

• Age

• Health

• Lifestyle

• Coverage type

• Policy structure

This is why personalized guidance matters. There is no universal price.

How much life insurance do I need?

There is no one size fits all answer. Coverage depends on:

• Income

• Debts and mortgage

• Family size

• Lifestyle

• Long term goals

A general guideline is 10 to 15 times your annual income, but a proper review ensures the amount truly fits your situation.

What are the main types of life insurance?

Term Life Insurance

Coverage for a specific period of time. Typically the most affordable option.

Permanent Life Insurance

Coverage for life that may include a cash value component. This includes whole life and other permanent options.

Each type serves a different purpose depending on goals, budget, and long term planning needs.

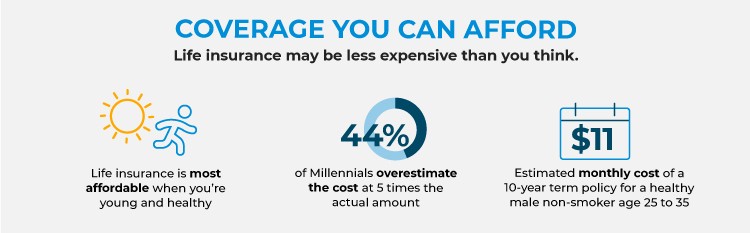

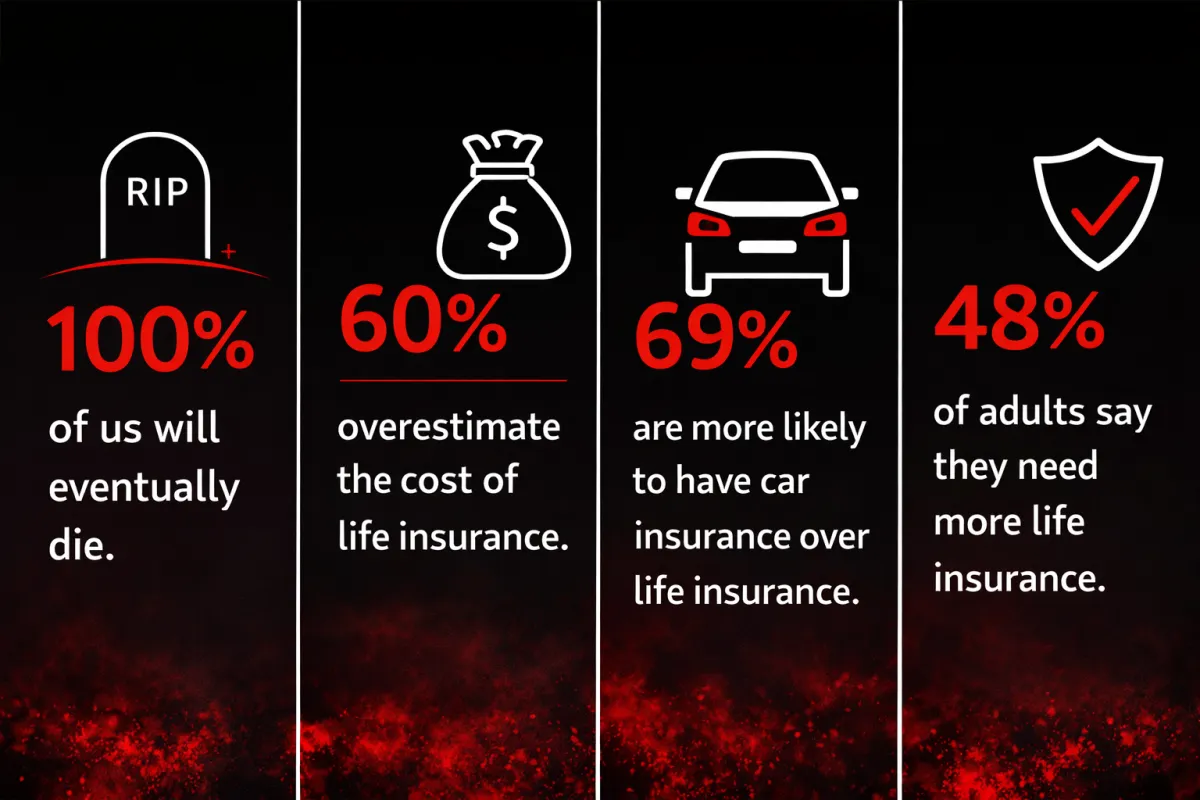

Is life insurance expensive?

This is one of the biggest misconceptions. Many people are surprised by how affordable life insurance actually is, especially when purchased while young and healthy.

In many cases, coverage costs less than:

• Monthly streaming subscriptions

• Dining out

• Cell phone upgrades

The cost of not having life insurance is often far greater.

I am young and healthy. Should I wait?

Waiting usually makes life insurance more expensive. Rates are based on age and health. Locking in coverage earlier often means:

• Lower monthly costs

• More options

• Better long term protection

Life insurance is easiest and most affordable when you do not urgently need it.

What happens if my health is not perfect?

You can still qualify for life insurance. Many carriers specialize in different health profiles. As brokers, we shop multiple companies to find the best option for your situation.

Is life insurance the same as a savings account?

No. Life insurance is not meant to replace savings. It complements it.

Savings accounts grow slowly and may not be enough to replace income or pay off large debts immediately. Life insurance provides instant protection from day one, even if you have not had time to save.

Both play an important role in a financial plan.

Is life insurance better than investing?

They serve different purposes.

Investments are designed for long term growth and retirement. Life insurance is designed for protection and certainty. Life insurance provides guaranteed funds when your family needs them most, regardless of market conditions.

Many families use both together.

“What happens if I outlive my term policy?”

If a term policy expires, coverage ends unless it is renewed, converted, or replaced. Many term policies include options to convert to permanent coverage or extend protection.

Planning ahead helps ensure you are not left without coverage later in life.

Remember, term is life insurance coverage for a set time period

Is cash value policies right for everyone?

Not always. Cash value policies are typically more expensive than term insurance and are best for people who:

• Want lifetime coverage

• Are focused on long term planning

• Value stability and guarantees

• Already have basic protection in place

This is why education and proper guidance matter, to help you make the best decision that fits your needa.

What Is Final Expense Coverage?

Final expense insurance is a type of life insurance designed to cover:

• Funeral costs

• Burial or cremation

• Medical bills

• End of life expenses

This coverage is typically:

• Smaller in amount

• Easier to qualify for

• Designed to ease the burden on loved ones

Final expense ensures families are not left scrambling to cover immediate costs.

What Is an IUL (Indexed Universal Life)?

An Indexed Universal Life (IUL) policy is a type of permanent life insurance that provides lifetime coverage while also offering the potential to build cash value over time.

What makes an IUL unique is how the cash value grows. Instead of earning a fixed rate or being directly invested in the stock market, an IUL’s cash value growth is linked to a market index.

Most IUL policies are linked to well-known market indexes such as:

• The S&P 500

• The NASDAQ

• The Dow Jones Industrial Average

The most common index used is the S&P 500, which tracks the performance of 500 large U.S. companies. It is important to note that your money is not invested directly in the stock market.

You are only tracking the performance of the index for the purpose of calculating interest credited to your policy.

Are IULs worth it?

IULs can be valuable when used correctly and for the right reasons. They are not for everyone.

They may be a good fit for people who:

• Want lifetime coverage

• Are interested in cash value growth

• Have a long term outlook

• Understand the structure and limitations

They are not ideal for short term needs or for those who only want basic coverage. Education is critical before choosing an IUL.

Are IULs Risk Free?

No financial product is completely risk free. While IULs protect against market losses, they come with:

• Fees

• Caps on gains

• Policy structure requirements

An IUL must be properly designed and funded to perform as intended.

“If I get life insurance now, am I stuck with it forever?”

No. Life insurance is not a lifetime commitment unless you choose it to be.

Policies can be:

• Reviewed

• Adjusted

• Replaced

• Supplemented

Just like technology evolves, or even iphones update, life insurance policies evolve too. New products, better features, and more flexible options become available over time. What made sense years ago may not be the best fit today.

“Can I update or change my policy later?”

Yes. Life insurance should be reviewed as life changes.

Major life events such as marriage, children, home purchases, career changes, or health changes are all reasons to revisit coverage. Policies can be adjusted or complemented with additional coverage as needed.